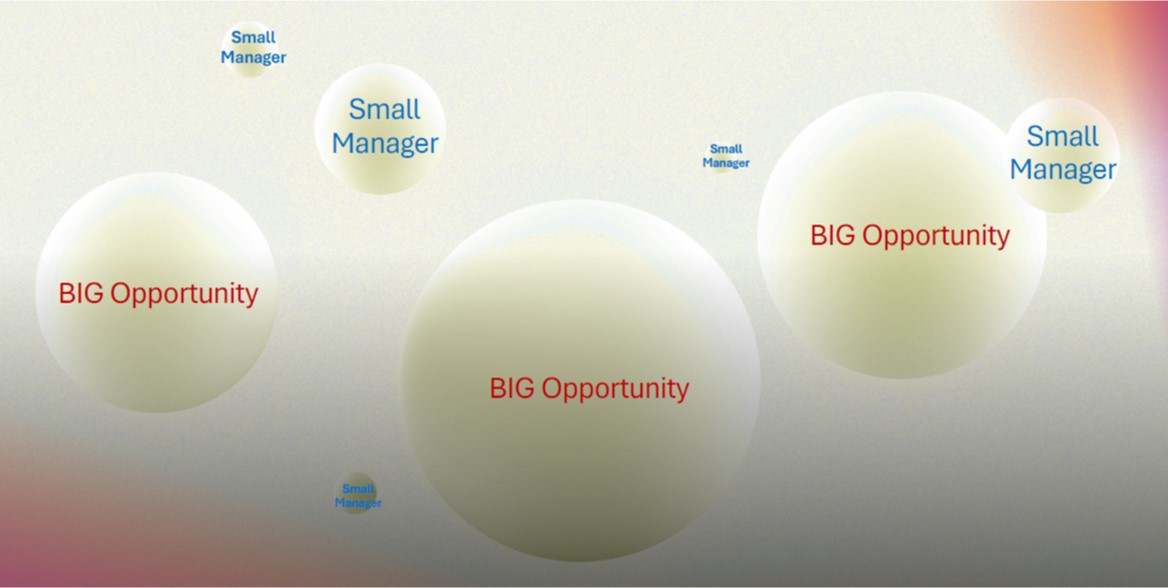

SMALL Manager, BIG Opportunity

Bigness has been having a big moment for quite some time now. Mag 7, AI spend/investments, Meta acqui-hires, gold, duct-taped auctioned banana, crypto etc. all depict the zeitgeist of recent times. Large asset managers have also been equally fortunate, raking in majority of institutional capital and now private wealth. While we cannot predict how the land of Goliaths will evolve, we can surmise that giant alternatives powerhouses could face challenging times ahead to hold onto their pole positions in the unfolding climate.

Small Manager Opportunity Knocks

First and foremost, the 40-year great moderation is giving way to a higher- for- longer interest rate regime. Despite rising odds of potential rate cuts to insure against near-term economic weakness, term premia are likely to grow with rampant fiscal deficits, increased sovereign debt issuances and rising inflation expectations spurred by higher defense, infrastructure spending, supply chain disruptions, and likely higher tariffs. Add to that any risk premiums from a cocktail of impending risks: loss of central bank independence, wars, climate change, etc. All put together, organically (bearish) steeper yield curves seem to be in the offing notwithstanding the stealth urge to impose a “third mandate” on the Fed to moderate long-term interest rates i.e. yield curve control!

Many mega alternatives managers who looked like rock stars in a bygone era of lower interest rates face a tsunami of challenges: competition for deals, lofty valuations, rising dry powder, declining returns, increased usage of PIKs/deferred defaults, looming maturity wall, more “accordion” features etc. Besides the phasing out of low interest rates that lifted all boats, a rapidly fragmenting multi-polar world is also likely to fragment the opportunity set for individual strategies in private markets. Though large alternatives managers are eagerly talking up asset-based finance (the “new investment grade credit”), capital solutions, secondaries etc. as the next big thing after direct lending, institutional investors already hurting from slower exits and low distributions appear skeptical of any new fat pitches that can absorb gobs and gobs of their capital as before. The savvier institutional investors are already balking at the synthetic liquidity created through a raft of measures e.g. continuation funds, secondaries, NAV financing etc.

Also, in a super geopolitically charged environment marred with ideological wars, large overseas investors like Sovereign Wealth Funds, Government Sponsored Entities, insurance companies etc. could become reluctant to endow larger US asset managers with their investable surplus. Why? Because US exceptionalism has become debatable and in many cases their surpluses face the threat of declining oil revenues and increased defense spending.

This could eventually lead sophisticated investors to become more open to pockets of less correlated opportunities and inclined to spreading their bets among multiple promising smaller managers across the globe. We already see evidence of some prominent allocators reducing the check size of any reups with larger managers.

A change in investor sentiment could then curb larger managers’ ability to raise jumbo funds as in recent years curbing their prowess to feed their monstrous infrastructures. To preempt that, we already see larger managers pushing hard into greener pastures e.g. private wealth, retirement accounts, perpetual insurance capital etc.

As highlighted in a May 2025 Fed paper “Bank Lending to Private Credit: Size, Characteristics, and Financial Stability Implications” , some of these interconnections especially among banks, insurance companies, and large private credit managers appear incestuous risking contagion and increasing systemic vulnerabilities. Also, some of these new tie ups, especially with traditional money managers-age-old providers to 401 (k) accounts-have resulted in culture clashes resulting in talent flight. To worsen matters, if carried interest participation and other performance incentives remain elusive in a less sanguine investing atmosphere, it could rob marquee managers of talent who they once flaunted which in turn could threaten performance. Institutional investors also fear that the distraction from pursuing new retail money can shift focus of their stewards of capital away from maximizing returns for their capital that bankrolled big managers in the first place.

All in all, the big manager craze among institutional allocators is likely to ebb gradually creating room in their portfolios for smaller managers targeting pockets of opportunities. By definition, these niche opportunities are likely capital constrained that justify smaller capital raises. However, it won’t be a slam dunk for these managers either when prospecting institutional investors, as most are accustomed to allocating to large managers who boast massive infrastructures, project operational stability, and pose little career risk for allocators.

Seizing the Small Manager Opportunity

So, while the much-awaited opportunity for smaller managers is on the horizon, managers need to bode all-round investor conviction- the raison d’etre of EMA’s Moody’s- like independent investment audit/due diligence.

First, they need to be operating at least above breakeven levels for the size of their operations to suggest operational stability. Secondly, despite their operations being small, the team needs to be organized such that all essential functions are taken care of without concentrating too much in just a couple of hands (though investors recognize that in small teams people wear multiple hats). Distributing people in various roles speaks to the attention the manager accords to functional areas (e.g. independent risk management, legal, valuation etc.) and shows that checks and balances are in place, both hallmarks of an institutional set up. But above all, the managers must have a differentiated opportunity or a unique strategy or execution to set them apart from their closest peer group and even their larger brethren.

However, niche opportunities/strategies carry issues of their own. Since these are not mainstream strategies e.g. music royalties, sports/entertainment, Asian non-sponsored lending etc., it requires a lot of investor education. The same underlying thesis needs to be delivered over and over again through a variety of thought leadership pieces distributed through various channels- webinars, whitepapers, podcasts, press articles etc. Given the idiosyncratic nature of these opportunities the onus is on managers to educate investors. Only when the message is broadcast wide and repeatedly, does it start resonating with investors to evoke any serious interest beyond initial intrigue. A casual LP interest often misleads managers into believing an investor is sold on the idea setting off a spree of nagging calls and emails that can turn off any potential prospect.

Small Manager: Dos and Don’ts

In our experience, prior to taking on an “outsourced product specialist” mandate (suited for early-stage managers/complex strategies instead of undergoing a Moody’s-like investment audit), we find managers predisposed to hawking their fund with just a pitchbook and going from meeting to meeting leaving most investors bamboozled and some intrigued with their unique strategy. Because the strategy has not sunk in, it’s most likely forgotten by the time/IF a manager gets a second meeting with a prospect. And if there are new attendees on the allocator’s side, it means starting the process all over again because there’s little by way of a knowledge bank created for new attendees or even the old ones to resort to.

Secondly, the fund vehicle should be structured such that it supports the underlying strategy especially in terms of liquidity, any intermittent dividends etc. Equally important is for the vehicle structure to conform to the preferences of the manager’s main target audience (see below) and not one all-encompassing “mousetrap” for all types of investors (e.g. private wealth and institutional). Also, it’s important to map the landscape for funds in the nearest peer group to develop a competitive term sheet comprising tenor, management fees, carried interest, hurdle rates, waterfall etc.

The third problem we find is managers peddling their precious capacity to all and sundry in their desperate attempt to raise any capital. There is little in the form of an outreach strategy i.e. a targeted investor profile e.g. pensions, endowments etc. that the fund most likely appeals to given its risk-return attributes, size, operating geography, liquidity terms etc. It is imperative to define one’s target audience and pursue only those kinds of investors who are likely to have a natural appetite for a manager’s strategy. In this regard, it is important to understand investor preferences through a series of tests: manager meeting notes, history of recent investments, background of key decision makers etc. At the end of the day the mind set should be one of building a market following /loyal investor base that understands the manager’s strategy and philosophy and has conviction in the team. A fair initial understanding also allows investors to come to terms with any underperformance to allow them to give the manager another chance, else they are unlikely to reup in successive funds.

And finally, it is important to have a well-stocked and organized data room for investors who are genuinely interested. The messaging in every piece of collateral in the data room should be consistent in content and nomenclature as well as support the overall thesis. By the same token duplication should be avoided and every piece should be additive to building an investor’s knowledge and thus confidence. We find in our experience that managers are quite eager to open their data room to almost anyone right after an initial meeting thus inviting “tourist analysts” looking for comps, talking points or self-advancement/career opportunities etc. If investors have not understood or bought into a manager’s strategy they are likely to get lost in the treasure trove of information in the data room or take one nugget of information out of context that will feed their bias forever that’ll keep them from giving the manager a second chance. Therefore, the data room should be opened to prospects only after a few engaging conversations that allow investors to develop a foundational understanding through deal walkthroughs, by questioning the thesis and execution, and asking what-ifs, interviewing a few key people etc. It is only then can investors cultivate genuine interest in wanting to diligence further to validate their initial understanding, and see evidence of investment process and operational conduct. Any invitation to enter the data room before that could be counterproductive. In other words, a data room ought to be presented to investors as a well-organized diligence hub not a cluttered warehouse of random documents filled with jargon and legalese.

In summary, we think the clouds could be parting for smaller managers ahead but to seize the opportunity, they must have the makings of institutional-quality large managers that allocators are so used to and approach prospects with tools to build investor conviction (e.g. an investment audit) and a well-defined go-to-market strategy.

Readers might also find it interesting to listen to: Small Manager, Big Opportunity that has some echoes of our comments above.

ÊMA remains committed to empowering smaller managers solve for LPs. Please reach out with questions, comments or inquiries how ÊMA might be able to help YOU solve for LPs.

Yours Truly,

Kamal Suppal

Chief Investment Auditor

The above content is intended for sophisticated audiences as in institutional investors or family offices. Readers are advised that any theme or idea discussed above is not an offer to buy or sell any investment.